Support center +91 97257 89197

Generative AI developmentJuly 23, 2024

How AI is Shaping the Future of Wealth Management — Benefits and Applications

Introduction

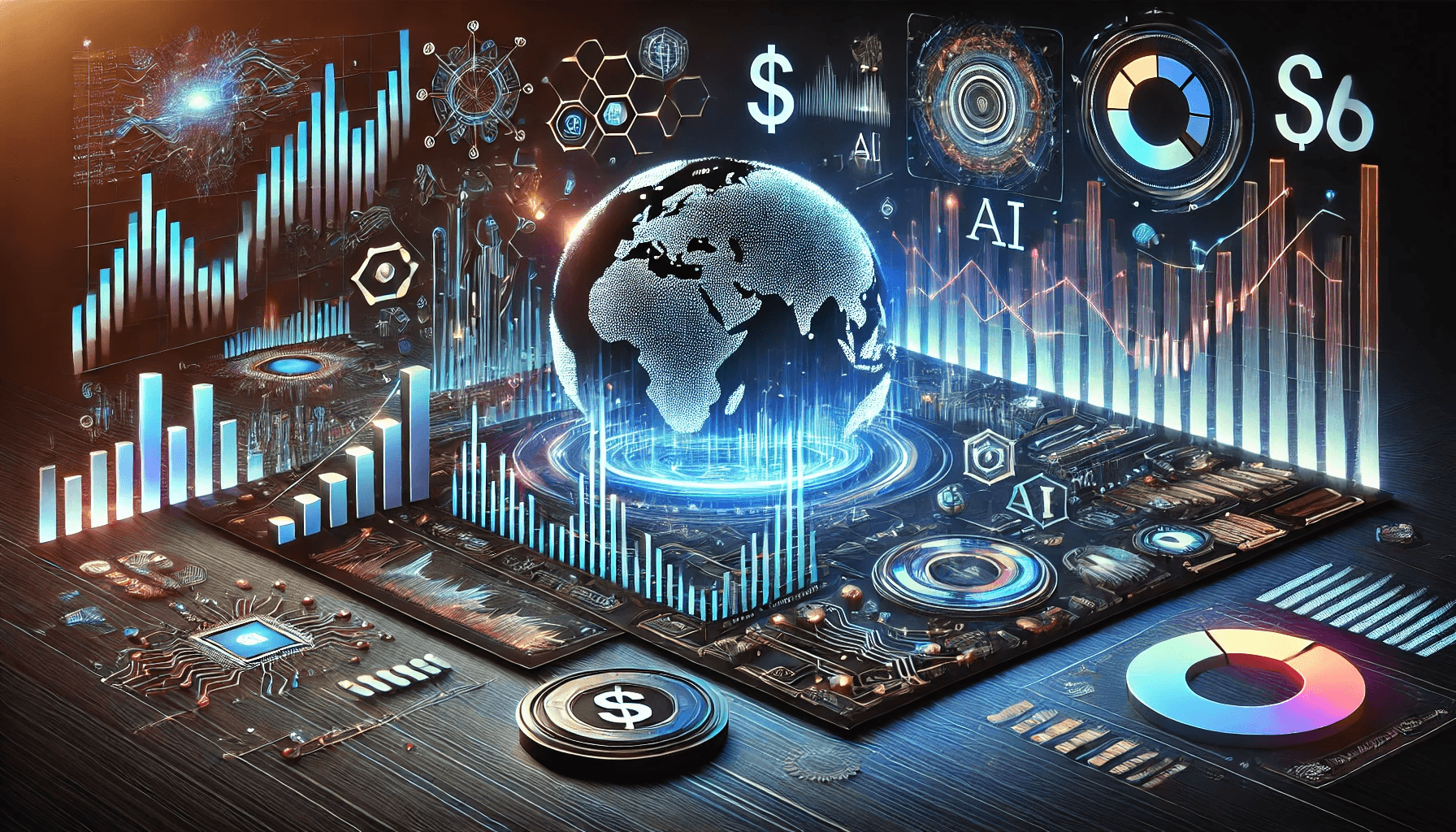

Artificial Intelligence (AI) is revolutionizing multiple sectors, and wealth management is no exception. From automating investment advice to optimizing portfolios, AI is enabling financial institutions to deliver more personalized, data-driven services while reducing costs and improving efficiency. As the demand for smarter, faster financial solutions grows, AI is emerging as a powerful tool to meet these needs, reshaping the traditional landscape of wealth management.

Core Applications of AI in Wealth Management

1. Robo-Advisors: Automating Investment Advice

Robo-advisors are perhaps the most visible example of AI in wealth management. These automated platforms use algorithms to manage and optimize portfolios based on a user’s risk tolerance, financial goals, and market data. Unlike traditional advisors, robo-advisors operate 24/7, providing clients with continuous monitoring and updates to their portfolios. Major players like Betterment and Wealthfront have already made waves, offering low-cost, AI-driven solutions that democratize access to investment advice.

2. Predictive Analytics for Market Trends and Risks

One of the most powerful AI applications in wealth management is predictive analytics. AI algorithms can analyze vast amounts of historical and real-time data to forecast market trends, identify emerging risks, and suggest optimal investment strategies. This provides financial advisors with actionable insights, allowing them to offer more precise, data-driven advice to clients. By predicting market fluctuations or potential downturns, wealth managers can make proactive decisions to protect or grow client portfolios.

3. AI-Driven Portfolio Management and Optimization

Portfolio management has traditionally been a time-consuming process, requiring constant analysis of market conditions, asset allocation, and individual client profiles. AI simplifies this by automating much of the process, continuously monitoring portfolios and making real-time adjustments based on market data and predictive models. AI-driven portfolio management tools also enable wealth managers to create highly personalized portfolios, tailoring asset allocation to each client’s specific goals and risk tolerance.

Benefits of AI in Wealth Management

1. Enhancing Decision-Making with Data-Driven Insights

AI provides wealth managers with unprecedented access to data and insights. Machine learning algorithms can parse massive amounts of market, financial, and behavioral data to offer recommendations that human advisors may overlook. This not only enhances decision-making but also allows firms to act quickly on new opportunities or risks. For example, AI can spot correlations between different asset classes that might not be immediately apparent to human analysts, improving both returns and risk management.

2. Improving Customer Personalization and Experience

AI enables a new level of personalization in wealth management. Clients today expect more than generic advice—they want tailored strategies that align with their unique financial goals and circumstances. AI-driven tools can analyze a client’s spending habits, investment preferences, and risk profile to create customized recommendations. Hyper-personalized services, such as sending specific financial insights based on life events, help build stronger relationships with clients and increase satisfaction.

3. Reducing Operational Costs Through Automation

One of the key benefits of AI is its ability to automate routine tasks, drastically reducing operational costs. From client onboarding to regulatory compliance and portfolio adjustments, AI systems can handle tasks that traditionally require significant human labor. This not only cuts down costs but also increases operational efficiency, allowing wealth managers to focus more on strategic activities and client interactions.

Risk Management and Fraud Detection

In addition to its benefits for portfolio optimization and customer experience, AI plays a critical role in risk management and fraud detection. AI algorithms can continuously monitor financial transactions and identify unusual patterns that may indicate fraudulent activities. By analyzing vast datasets and comparing transaction patterns with known fraudulent behaviors, AI systems can alert wealth managers to potential risks in real time. This proactive approach helps firms mitigate risks before they cause significant financial damage.

AI’s ability to assess risk also extends to client portfolios. With predictive analytics, wealth managers can anticipate market downturns and adjust client investments accordingly, safeguarding against excessive losses.

Challenges of Implementing AI in Wealth Management

Despite its vast potential, implementing AI in wealth management comes with its own set of challenges. One of the primary concerns is data privacy. AI systems rely heavily on data, and ensuring that sensitive financial information is protected is a major challenge, especially with increasing regulatory scrutiny. Financial institutions must ensure that AI tools comply with all relevant privacy and security standards, such as the General Data Protection Regulation (GDPR) and other financial regulations.

Ethical considerations also play a role in AI adoption. There’s a need for transparency in AI-driven decisions, particularly in areas like investment advice, where clients must trust the system’s recommendations. Ensuring AI algorithms are unbiased and fair is essential to maintaining that trust.

Future Trends of AI in Wealth Management

1. AI and Blockchain Synergy

One of the most promising developments in AI is its potential integration with blockchain technology. Blockchain provides a decentralized, transparent ledger, which, when combined with AI, could revolutionize data handling in wealth management. AI can analyze blockchain data to enhance security, improve transparency, and create more accurate models for investment strategies. Smart contracts, powered by blockchain, can automate transaction settlements, reducing the time and costs associated with traditional financial processes.

The combination of these two technologies promises to increase trust between clients and financial advisors by ensuring data integrity and improving the transparency of investment decisions. In the future, this integration could also lead to the creation of decentralized finance (DeFi) platforms, where AI-driven tools provide real-time, trustless financial advice without the need for human intermediaries.

2. The Rise of More Sophisticated AI Models

As AI technology continues to evolve, wealth managers can expect to see the development of even more advanced models capable of processing increasingly complex datasets. Current AI systems are already proficient in recognizing patterns and making predictions based on historical data, but future models will be able to incorporate real-time, dynamic data, such as geopolitical events, regulatory changes, and even climate factors, into their predictions.

These sophisticated models will also be able to simulate various market scenarios, providing wealth managers with better insights into potential risks and opportunities. This will further enhance the ability to tailor investment strategies to individual client needs, considering not only traditional financial data but also external factors that influence market performance.

3. Fully Autonomous Financial Management Tools

In the coming years, AI may enable the development of fully autonomous financial management platforms that require little to no human intervention. These tools would be capable of managing an entire portfolio, from investment decisions to tax optimization, in real-time. Clients would benefit from the precision and efficiency of AI-driven systems that can react instantaneously to market changes.

For example, a fully autonomous platform could automatically rebalance a portfolio when it detects a change in market conditions or client goals, ensuring optimal asset allocation at all times. While human advisors would still play a role in providing personal insights and strategic oversight, these AI-driven platforms could handle most of the day-to-day tasks, allowing wealth managers to focus on higher-level decisions.

Conclusion

AI is undeniably transforming the landscape of wealth management. From robo-advisors and predictive analytics to fully autonomous financial tools, AI’s applications are reshaping how financial services are delivered. The benefits of AI are clear: more personalized financial advice, better risk management, and reduced operational costs. However, as with any new technology, challenges such as data privacy and ethical concerns must be addressed.

As AI continues to evolve, wealth managers and financial institutions must stay ahead of the curve by adopting these technologies strategically. The future holds exciting potential, with AI not only optimizing financial strategies but also revolutionizing how wealth management is approached in a world where data is king.

TLDR

AI is revolutionizing wealth management by automating advisory services, improving decision-making, and enhancing personalization. Key applications include robo-advisors, predictive analytics, and AI-driven portfolio management. AI’s ability to streamline operations and manage risk is transforming how financial firms operate, but challenges like data privacy and ethical considerations remain.

FAQs

AI improves decision-making, provides personalized financial services, and reduces operational costs by automating routine tasks like portfolio management and market analysis.

Robo-advisors use algorithms to offer automated financial advice, allowing investors to receive tailored investment strategies without human intervention.

AI analyzes large datasets to predict market trends and potential risks, helping wealth managers make informed decisions and identify fraudulent activities.

Common challenges include data privacy concerns, regulatory compliance, and integrating AI with existing legacy systems.

Future trends include the use of blockchain with AI, more advanced predictive models, and fully autonomous AI-driven wealth management systems.

Work with us